Key Early Figures

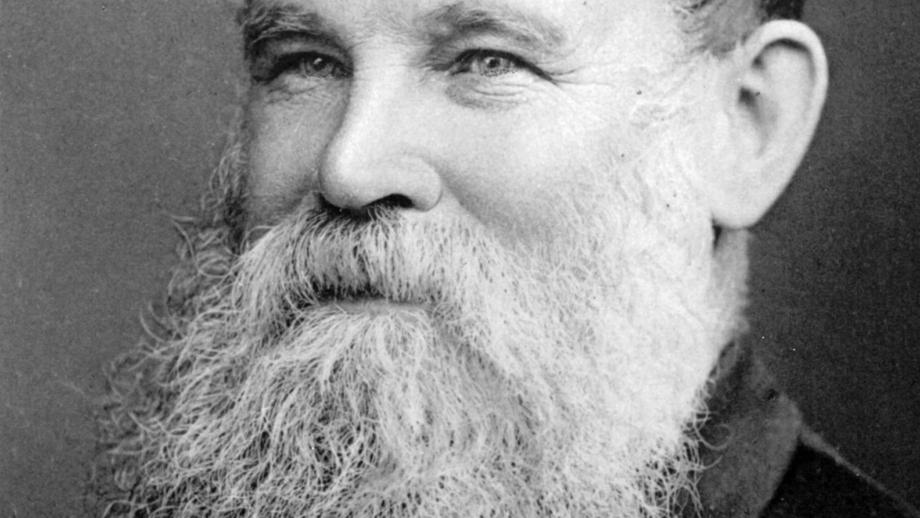

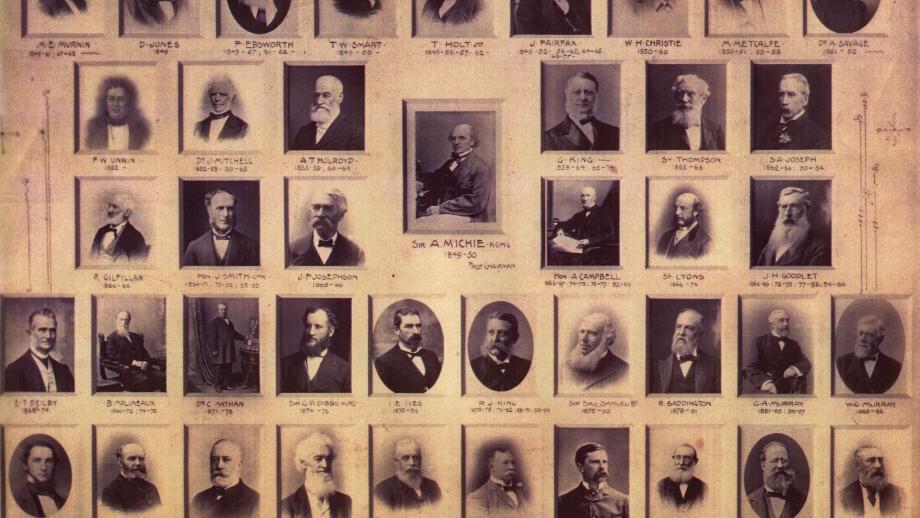

Thomas Holt, Co-Founder and Director

Thomas Holt was a wool merchant, financier, and politician who migrated to Australia from England in 1842 at the age of 31.

While working as a wool-buyer, Holt also became a magistrate. He went on to become one of Sydney's most prominent financiers and a foundation director and member of several goldmining, insurance and railway companies including the Australian Mutual Provident Society and the Sydney Tramway and Railway Company. He retained directorships in many of these companies until the 1870s.

Between the 1850s-1880s Holt acquired interests in pastoral properties across New South Wales and Queensland with a total area of approximately 3 million acres.

Holt played a leading role in the establishment of AMP and was present at the first meeting of the Society in 1848. He was AMP’s chairman from 1849 to 1856 and was largely responsible for instituting the protection of policies from creditors, something that AMP was the first in the world to introduce.

Holt attempted to enter the New South Wales Legislative Council twice before he was appointed colonial treasurer in 1856. It was at this point that he retired as AMP chairman. He finally succeeded in joining the New South Wales Legislative Council in 1868 and remained there until 1883.

Holt was a member of the Commission of Fisheries and Royal Society of New South Wales, as well as Vice President of the Royal Agricultural Society of New South Wales.

An active and charitable Congregationalist, he donated his residence, Camden Villa, for the establishment of Camden College, of which he became a council member and trustee.

In 1881 Holt returned to Britain and devoted himself to the poor of London and the Salvation Army.

He died on 5 September 1888 at his home in Kent, leaving an estate valued at nearly £330,000.

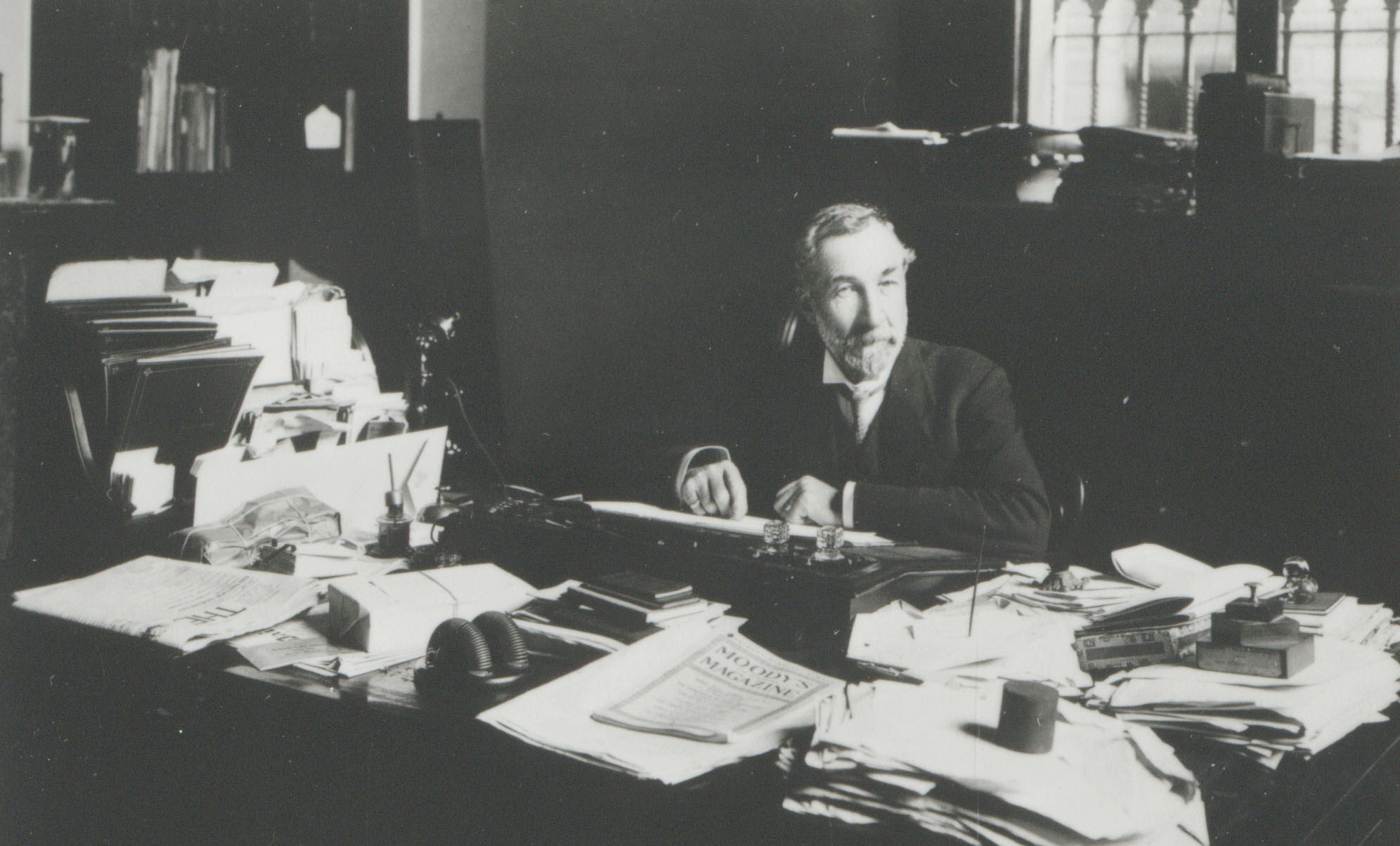

Morrice Black, Actuary

Morrice Black was born in Aberdeen, Scotland in 1830. At age 16 he commenced work in the insurance industry and studying actuarial science, before relocating to London, where he attained several executive positions by the mid-1860s. He was elected an Associate of the Institute of Actuaries in 1855, before attaining fellowship in 1869.

In 1868 Black was appointed actuary of the Australian Mutual Provident Society and he and his family relocated to Sydney. He was described as “a gentleman of great administrative capacity, enthusiastic in his profession and fertile in resources” (Woolmer, n.d.).

Black presented AMP’s statements and accounts more thoroughly than had ever previously been attempted. His first report included a review of the entire Society’s accounts since its establishment in 1849.

He was also responsible for transforming the way AMP did business, finding its risk aversion and extreme caution unwarranted and unfeasible. AMP originally applied surcharges on policies for those working in certain professions including bakers, mariners, police officers, goldminers, railway guards, and millers and for any residents of Queensland. Black ensured these surcharges and restrictive clauses were removed and consequently AMP saw a sharp increase in customers. Black also spent considerable time analysing and improving the mortality tables used by the Society.

Black strongly disapproved of AMP’s existing methods of dividing and distributing profits and proposed a new method in which bonuses and profits would be distributed annually rather than every five years. After travelling to London and submitting his case for approval before a committee of English actuarial authorities, Black’s new system was approved and resulted in another increase in customers.

In 1878 Black became a member of the Royal Society of New South Wales and in 1882 was appointed an Alderman of the Borough of Woollahra in Sydney’s Eastern Suburbs, a position he held until his death.

In the 1880s Black’s health began to decline and he died from Bright’s Disease, an inflammatory kidney disease now known as acute glomerular nephritis, in 1890. His grand home ‘Tivoli’ in Rose Bay was purchased by the Church of England and became Kambala Church of England Girls’ School.

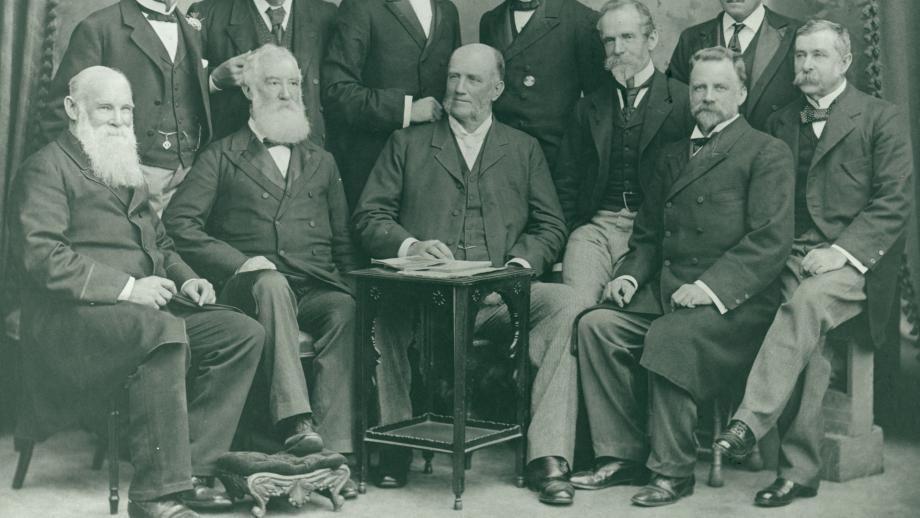

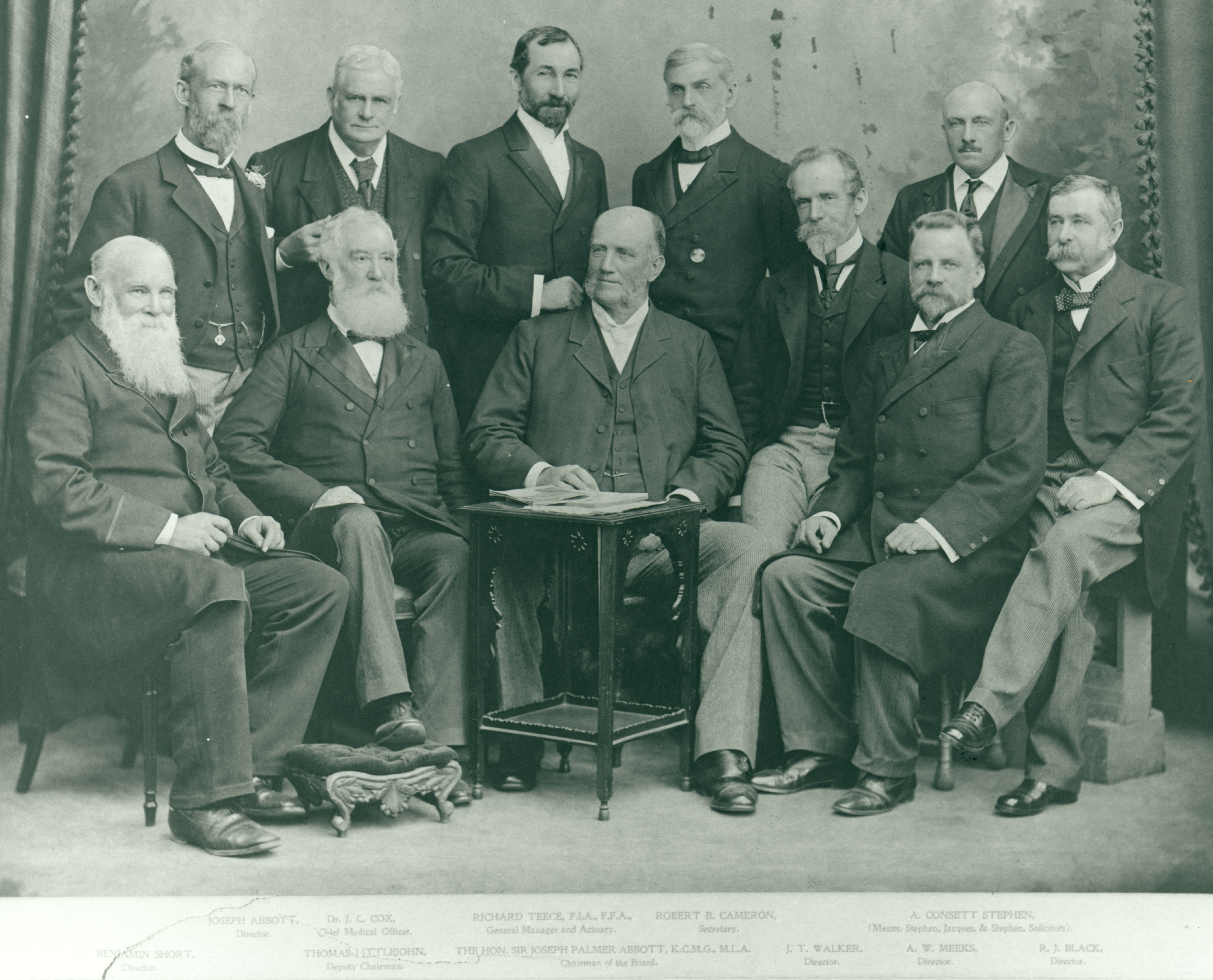

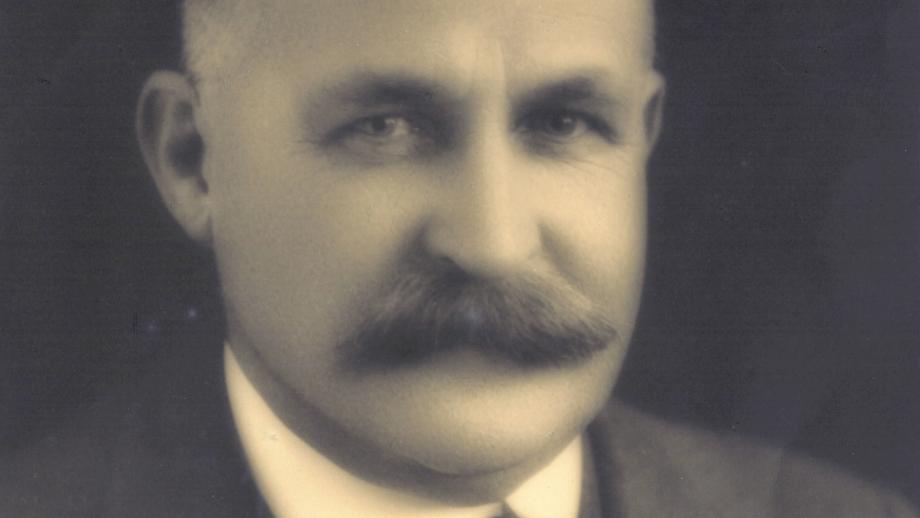

Richard Teece, Actuary and General Manager

Richard Teece was born in New Zealand in 1847 and settled with his family in Goulburn as a young boy. He studied at the University of Sydney but left to join the Australian Mutual Provident Society in 1866 as an actuarial clerk before being promoted to chief clerk in 1872. He eventually qualified as an actuary and attained fellowship of actuarial societies in Australia, England, Scotland, and the United States.

Teece was well known throughout the global insurance world and considered the mastermind of AMP’s magnificent growth. He worked for AMP for 50 years, including four years as secretary and 27 years as actuary and general manager. During his time at AMP the value of its funds grew from £310,000 to £35,000,000.

After retiring in 1917 at the age of 70, in accordance with AMP’s regulations, Teece continued to serve as a director of AMP’s board until 1927.

Teece’s appointment came amid increasingly strong competition in the industry and just prior to the economic depression and banking collapse that gripped the country. His actuarial skills steered AMP through a very challenging period. He was described as a “deadly mixture of the highly talented technical man and the high-pressure salesman; deadly because he was able to wade into the thick of it with any business opponent and be armed with a far greater technical knowledge than most” (Woolmer, n.d.). He challenged other life offices to “point to a success equalling that obtained by the Mutual Provident Society”.

Teece was very active in community life and was a board member of the Consumptive Hospital and Children’s Hospital, Deputy Grand Master of the Freemason’s United Grand Lodge; Vice President of the Sydney Philharmonic Society; Honorary Secretary of the New South Wales Cricket Association; Fellow of the University of Sydney Senate; Council Member of the University of Sydney Women’s College; and President of the Australian Economic Association, Actuarial Society of New South Wales, Insurance Institute of New South Wales, Sydney Mechanics' School of Arts, Free Trade and Liberal Association, and the New South Wales Club.

Teece took his life at his home in Point Piper on 13 December 1928 and was survived by his seven children.

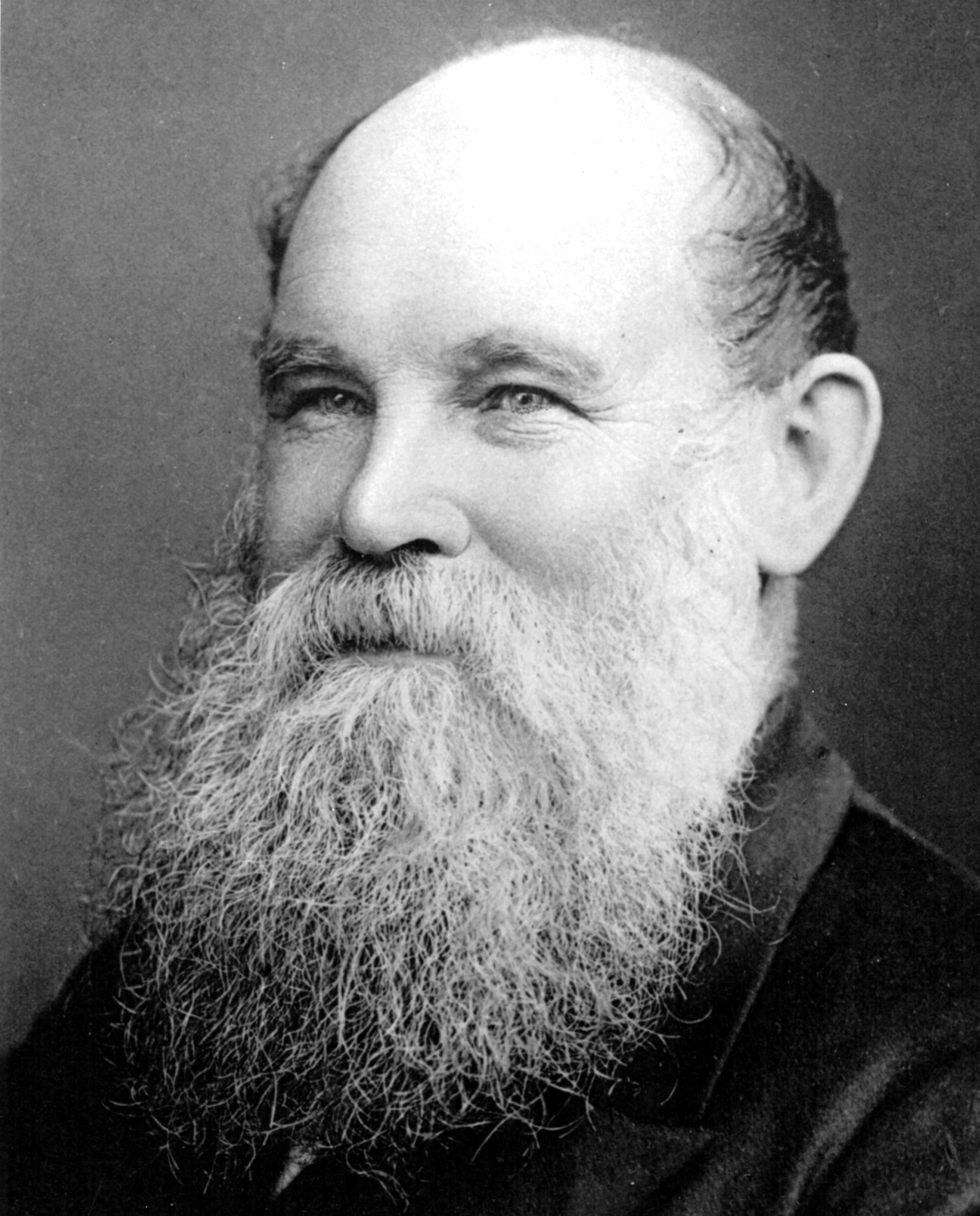

Benjamin Short, First Agent and Director

On 22 June 1860 Benjamin Short became the Australian Mutual Provident Society’s first full-time agent. Before this time, potential customers would call at AMP’s Pitt Street office or the home of one of its part-time agents.

Short arrived in Australia from England in 1860 with his wife and two children. He was a fervent Congregationalist, and the AMP Board considered his church connections very valuable.

Short travelled extensively, staging town hall lectures, speaking “with magnetism on the virtues of insuring one’s life” and suggesting it was one’s Christian duty to take out insurance to protect their family (Blainey, 1999).

Short was a natural salesman. At one stage, four out of every ten AMP policies was sold by him. During the late 1800s he was AMP’s number one salesman. In 1871 he relocated to New Zealand and transformed AMP’s business there before returning to Sydney in 1880. He was so successful that upon his return to Sydney he was given his own furnished office on George Street, a monopoly on AMP’s business around the CBD and North Shore, the right to employ his own sub-agents, and use of his own medical examiner (Blainey, 1999). In 1882 his annual earnings were recorded as an extraordinary £3,000, a figure worth close to $450,000 today.

Over the course of Short’s long and successful career with AMP, he was reported to have sold approximately 12,000 policies, a figure that was not surpassed by another agent until 1991 (Blainey, 1999).

Short retired to Bowral in 1886 but sought a position on the AMP Board in 1887 and 1891 before finally succeeding in 1892. As a director, a position he held until 1912, Short advocated for women to be insured on equal terms with men and for better terms for young members.

Short’s passion was religion and in 1862 he helped found the Sydney City Mission. He was also active in the Young Men's Christian Association, the British and Foreign Bible Society and helped found Congregational churches in Sydney and New Zealand.

Short died in Sydney on 10 June 1912, survived by his second wife and nine children.

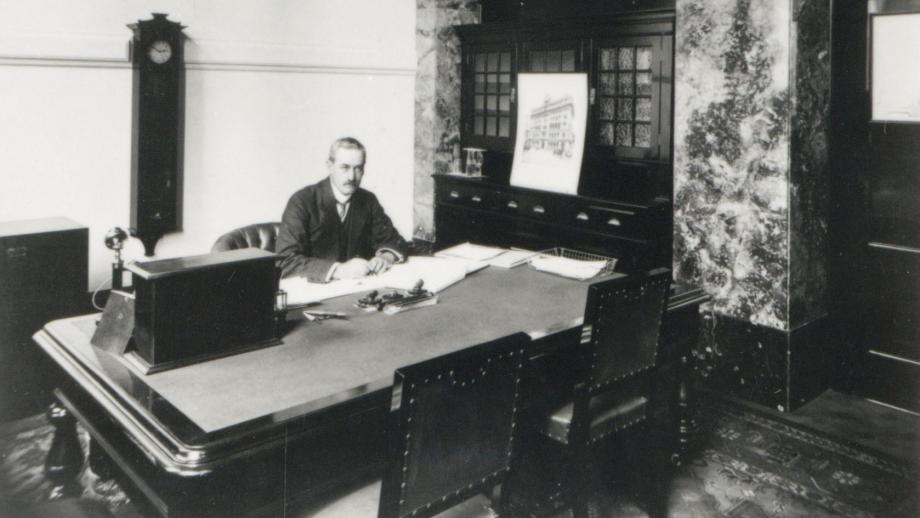

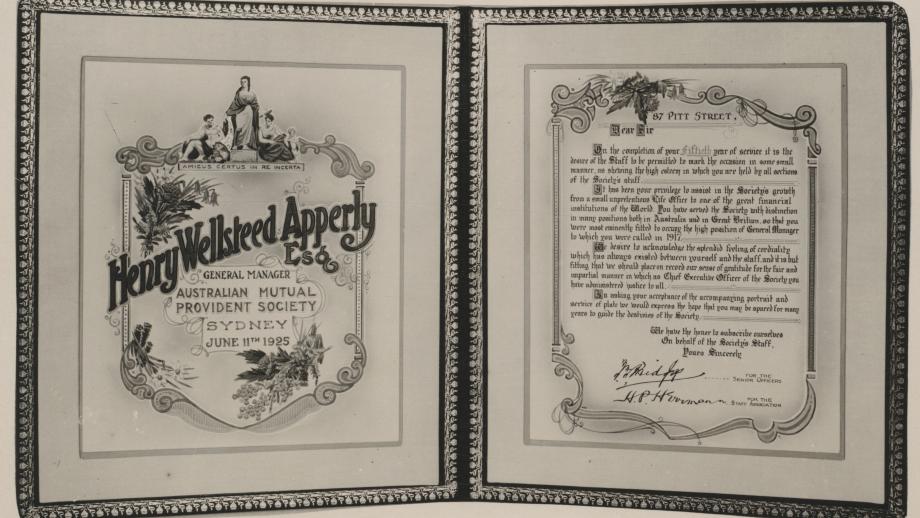

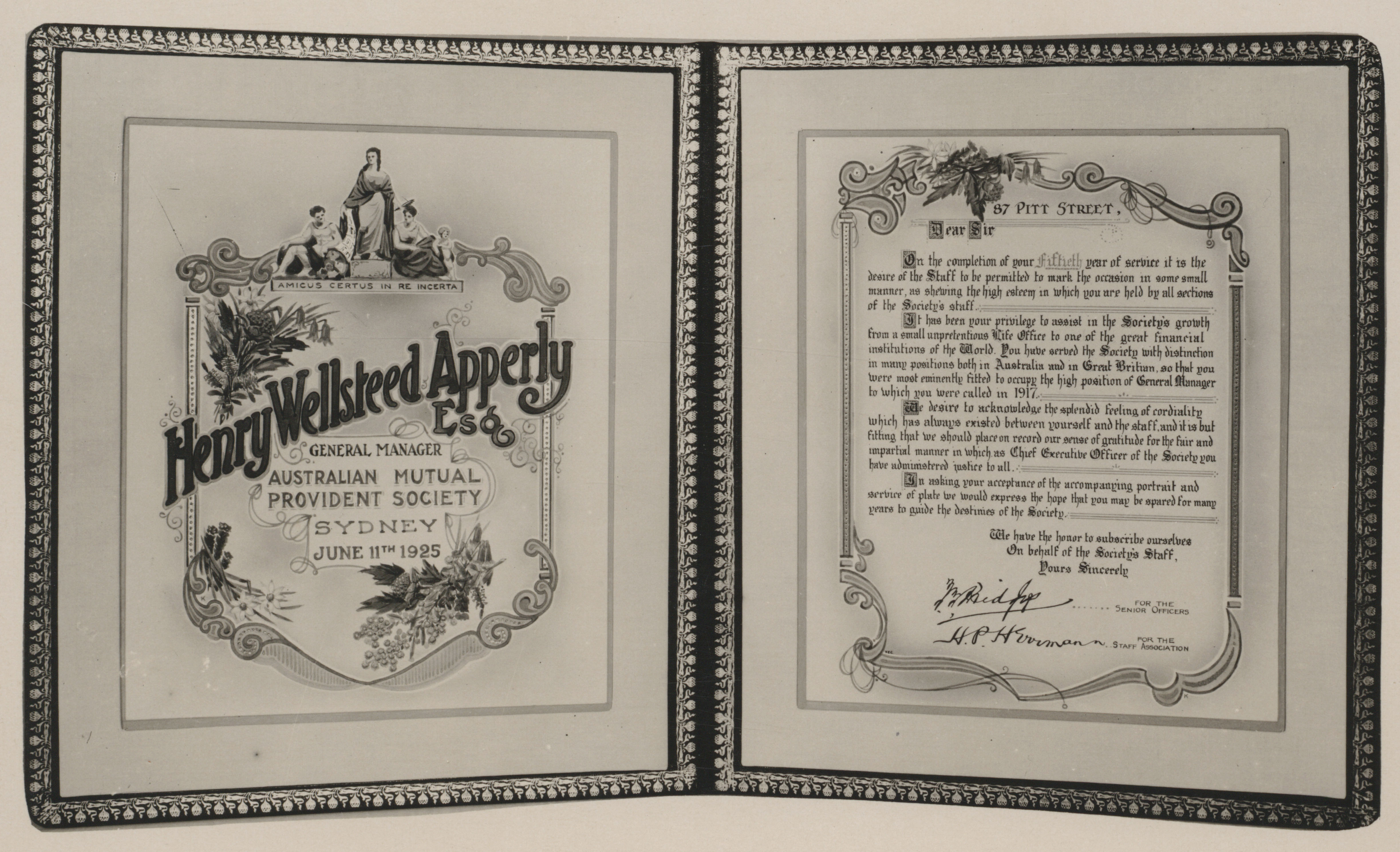

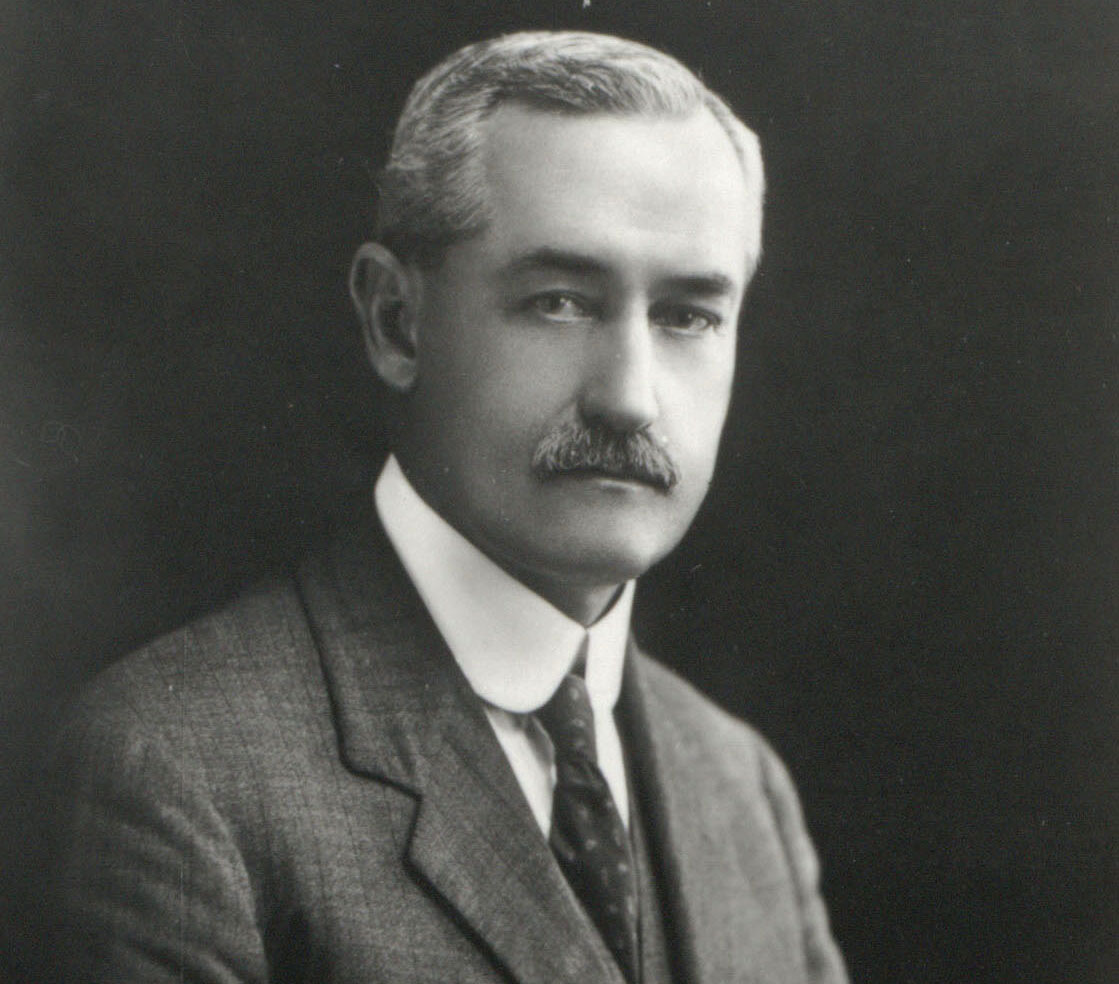

Henry Wellsteed Apperly, Secretary and General Manager

Born in Melbourne in 1861, Apperly was the son of reknowned sculptor Henry Apperly. After relocating to Sydney he attended Sydney Grammar School and passed the University of Sydney's senior examination at the age of just 13. Apperly joined AMP at the age of just 14 as a junior clerk through its competitive examination system. At a speech he gave for the AMP South Australia Branch jubilee in 1922, Apperly stated "I left school one Friday afternoon and joined AMP on the following Monday, and there I have been ever since".

Apperly's rise through the ranks was fast. In his early twenties he worked as an accountant in the Society's Adelaide, Melbourne and Sydney Offices before being appointed resident secretary of the Adelaide Office in 1893 and then the Brisbane Office in 1895.

In 1904 Apperly accompanied general manager Richard Teece on a world tour to investigate how insurance companies operated overseas. The following year, when AMP established its Industrial Department, Apperly was chosen as its inaugural manager and was key to its success.

In 1908, when AMP opened its long-awaited London Office, Apperly was asked to serve as its first resident secretary and received the handsome salary of £1,000 per year for doing so.

Apperly served as a loyal deputy to AMP Actuary and General Manager Richard Teece and the two worked very well together, although Apperly was quiety frustrated by Teece's stifling of the London Office by opposing higher commissions for British agents, something which saw AMP lose ground to its rivals.

When Teece was forced to retire in accordance with the Society's rules at the age of 70 in 1917, Apperly was his obvious successor. He faced the difficult task of seeing AMP through the final years of the First World War, an event that presented challenges that were almost beyond imagination. By this time Apperly was in his mid-fifties and had spent his entire career with AMP. He was skilled organiser with a cool head and was well-liked by the head office staff.

Apperly was extraordinarily dedicated to the Society and the sad circumstances of his death are testament to this. The day prior to his death he attended a conference between AMP's directors and the executive officers of the Agents' Federation. On the day of his death, Wednesday 16 July 1930, Apperly attended the usual AMP weekly board meeting but then reported feeling unwell and uncharacteristically left the office early to head to his home on Sydney's North Shore. While travelling on the train from Milsons Point to Wahroonga he suffered a heart attack and was found by a passenger who entered the train carriage and found him 'crumpled up on a seat'. He was aged 69. With his passing, AMP lamented it had lost not only its respected chief but its good friend.

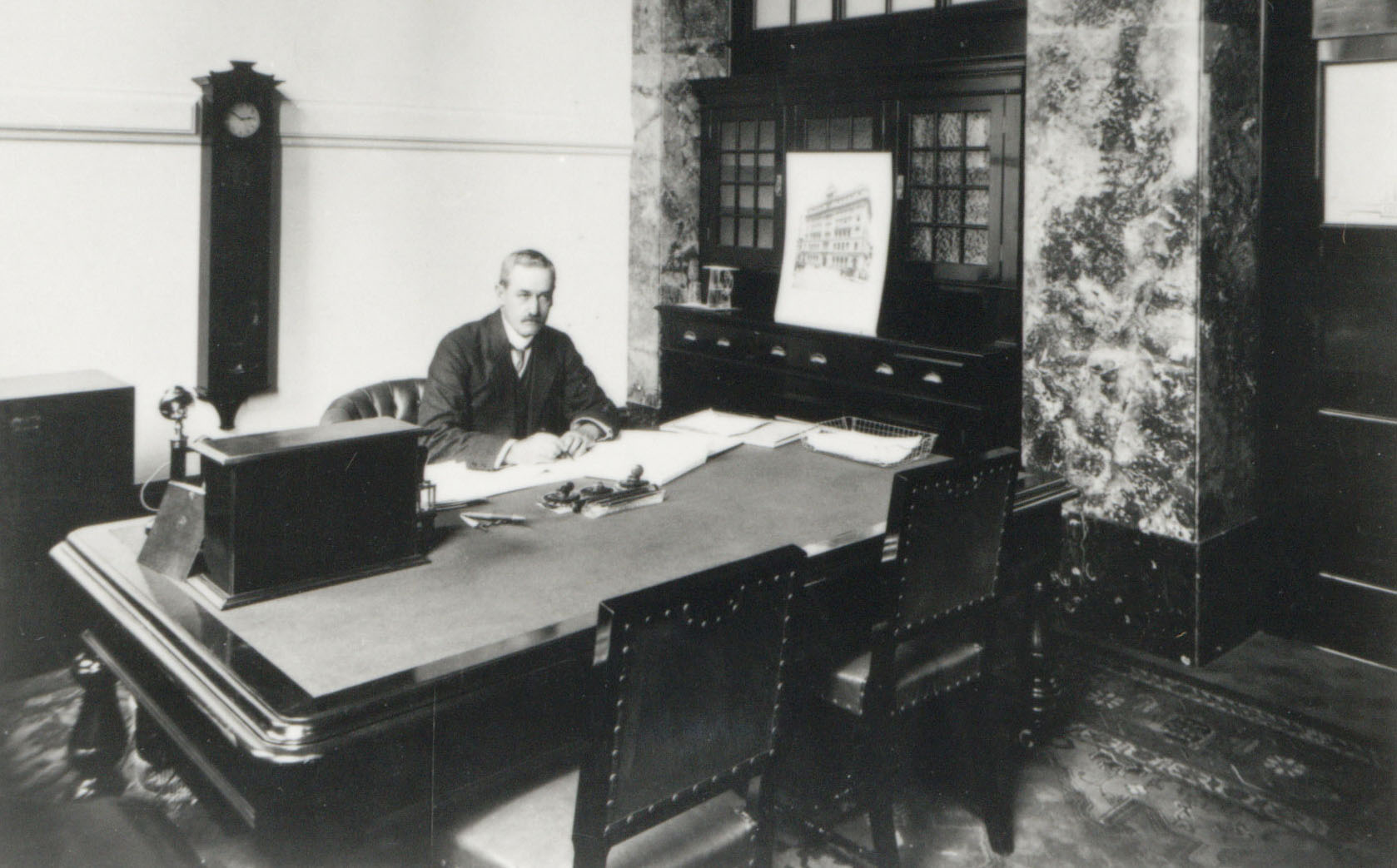

Andrew Sneddon, Actuary and General Manager

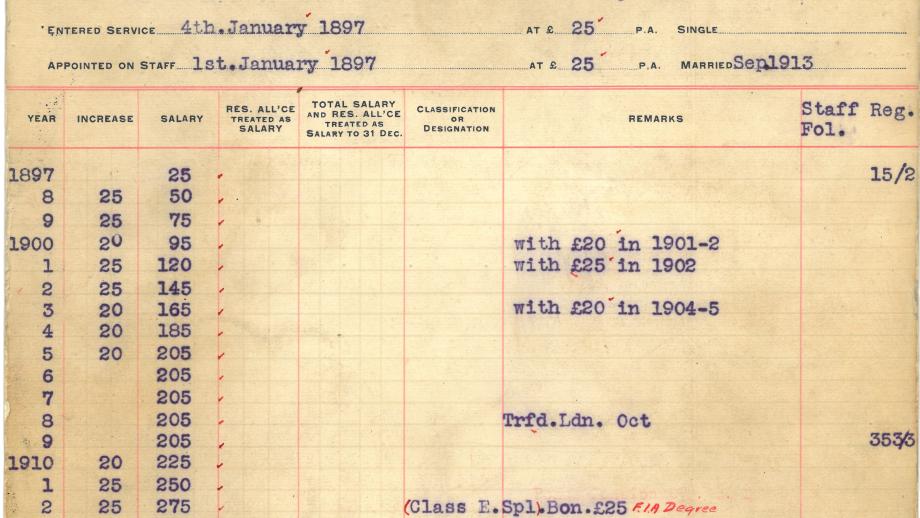

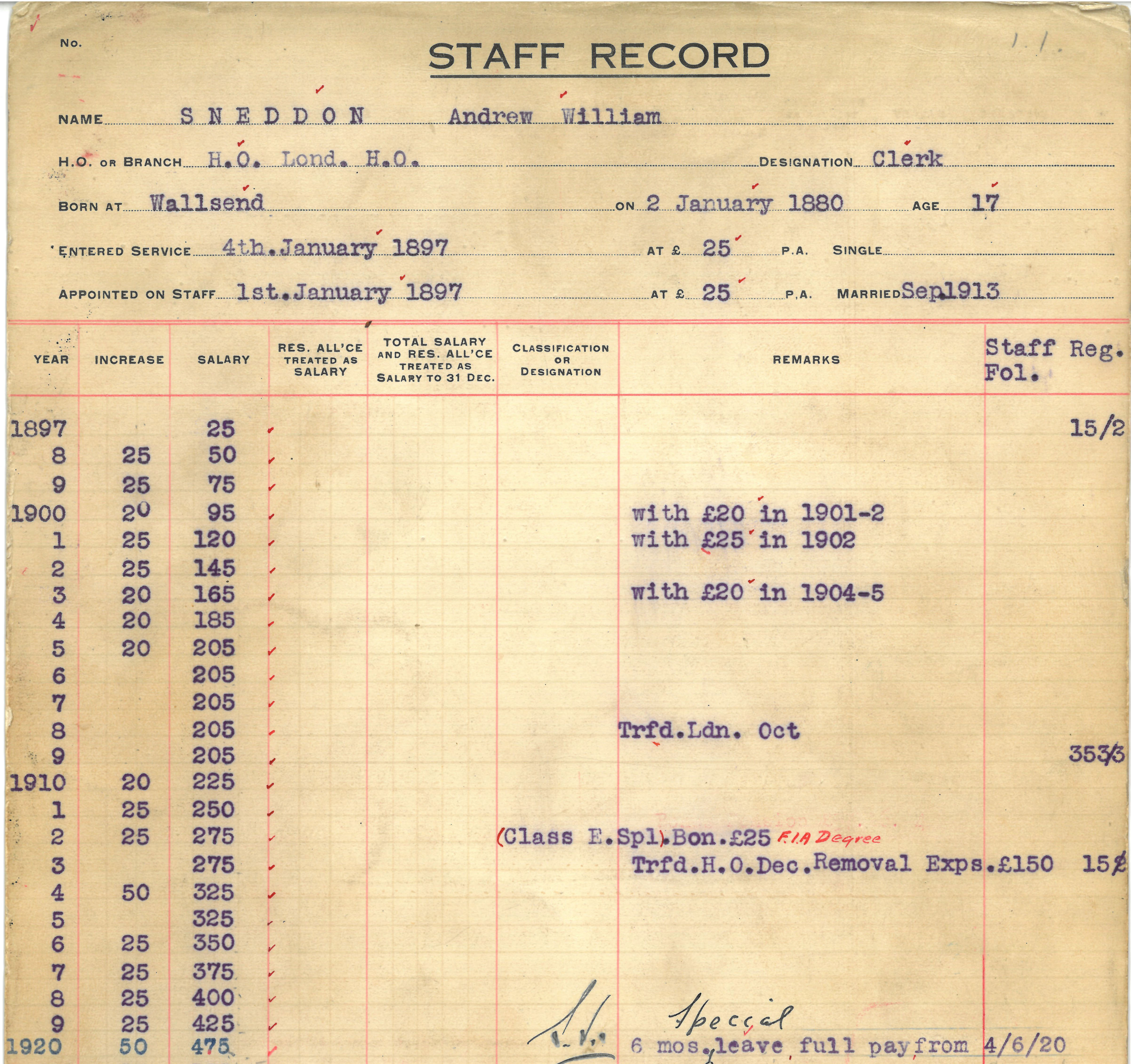

Andrew William Sneddon joined AMP at the age of seventeen in 1897, when he was appointed as a junior clerk in the Sydney Office. In 1908 he was transferred to the fledgling London Office and soon after completed his qualifications and was appointed a fellow of the Institute of Actuaries.

In 1914 Sneddon returned to Sydney where he completed the examinations to be admitted to the Institute of Incorporated Accountants of New South Wales.

In 1926 Sneddon was appointed manager of AMP’s Industrial Department and within eight years became general manager of the Society. In addition to his role as general manager, from 1938 he also held the position of actuary.

Sneddon realised the need for AMP to reinvigorate itself in the 1930s and do more to combat increasing competition. Under his leadership, selling was coordinated centrally, and new incentives were introduced for agents. Perhaps because of his background in the Society’s Industrial Department, he was a strong advocate of industrial assurance and saw this product as key to AMP’s success.

Sneddon oversaw changes to AMP’s constitution and government legislation via the Australian Mutual Provident Society (Amendment) Act in 1941, which allowed the Society to diversify its interests and become involved in the share market.

Sneddon was still leading AMP when he died suddenly in 1945 of a coronary occlusion at the age of 65.